Newsletter Subscribe

Enter your email address below and subscribe to our newsletter

Enter your email address below and subscribe to our newsletter

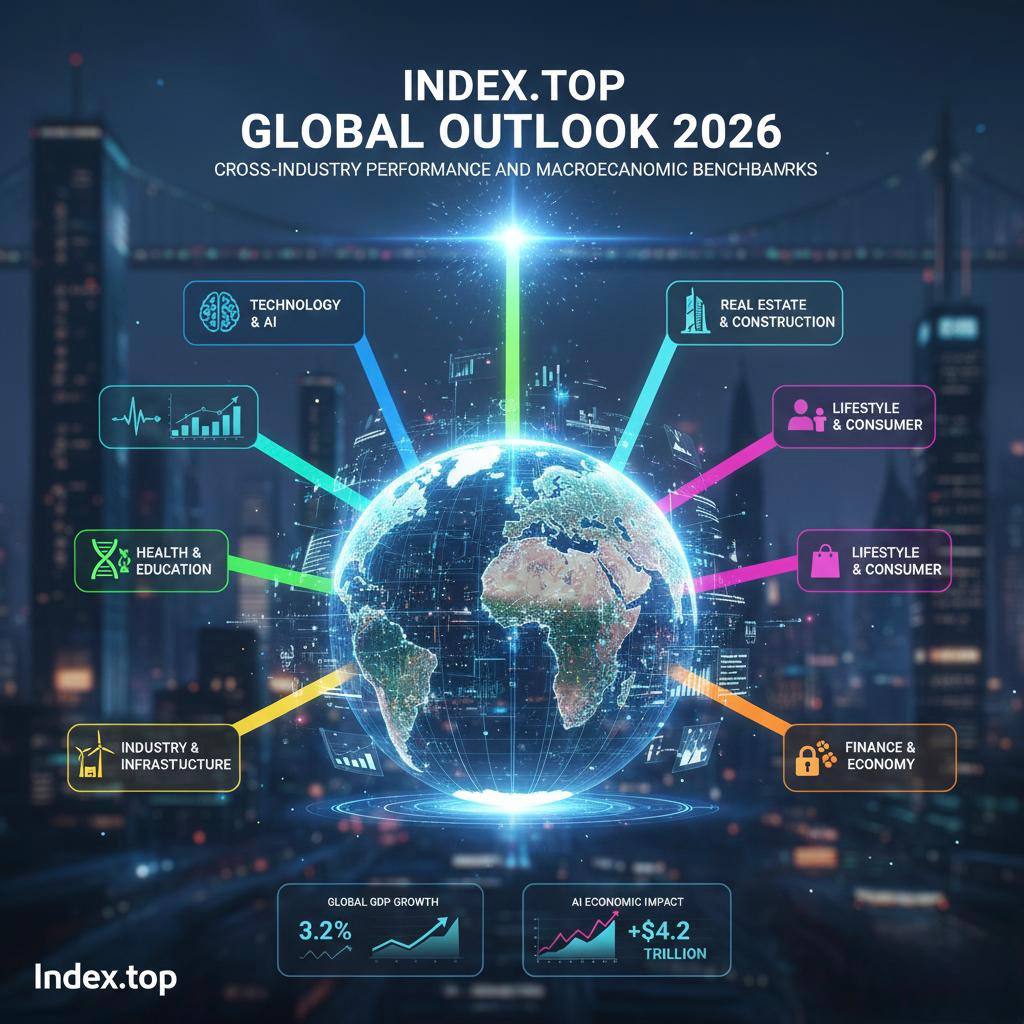

Entering 2026, the global economy has moved past the “inflationary shock” era into a period of “Structural Intelligence.” The Index.top Global Outlook 2026 synthesizes performance data across our core verticals. The defining narrative of this year is the AI Multiplier Effect, where productivity gains from autonomous systems are finally manifesting in hard GDP data. While global real GDP growth is projected to stabilize at 3.1% – 3.3%, the composition of this growth is heavily skewed toward sectors that have successfully integrated “Agentic AI” and “Green Infrastructure.”

The following benchmarks serve as the foundation for our 2026 cross-industry analysis:

This list represents the 50 most influential corporate and economic entities that define the global market landscape in 2026, ranked by a composite of Market Cap, Innovation Velocity, and Strategic Infrastructure Control.

| Rank | Entity | Sector | Primary 2026 Driver | Index Score |

| 01 | NVIDIA | Tech / AI | AI Factory Infrastructure ($4.5T Cap) | 99.8 |

| 02 | Apple | Lifestyle / Tech | Apple Intelligence Ecosystem | 98.9 |

| 03 | Alphabet (Google) | Tech / AI | Gemini 3.0 & Search Evolution | 98.2 |

| 04 | Microsoft | Tech / AI | Azure AI & Agentic Copilots | 97.5 |

| 05 | Amazon | Consumer / Cloud | AWS Bedrock & Automated Logistics | 96.1 |

| 06 | TSMC | Industry / Infra | 2nm Mass Production Leadership | 95.4 |

| 07 | Meta | Tech / Media | Llama 4 & Open-Source Dominance | 94.8 |

| 08 | Saudi Aramco | Energy / Infra | Energy Transition & Surplus Capital | 94.0 |

| 09 | Tesla | Industry / AI | Optimus Gen-3 & FSD Licensing | 93.3 |

| 10 | Broadcom | Tech / Hardware | Custom AI Silicon & Networking | 92.7 |

| 11 | JPMorgan Chase | Finance | Digital Banking & AI Wealth Mgmt | 91.9 |

| 12 | Eli Lilly | Health | Metabolic Disease Dominance (GLP-1) | 91.2 |

| 13 | Berkshire Hathaway | Finance / Diversified | Value Investing in AI-Era | 90.5 |

| 14 | Walmart | Lifestyle / Retail | AI-Driven Supply Chain Efficiency | 89.8 |

| 15 | UnitedHealth | Health | Predictive Healthcare Analytics | 89.1 |

| 16 | Novo Nordisk | Health | Chronic Disease Innovation | 88.4 |

| 17 | Visa | Finance | Real-time Cross-border AI Fraud Detection | 87.7 |

| 18 | ExxonMobil | Energy / Infra | Carbon Capture & Sequestration | 87.1 |

| 19 | ASML | Industry / Tech | EUV High-NA Lithography Monopoly | 86.4 |

| 20 | Mastercard | Finance | Identity-as-a-Service & FinTech | 85.8 |

| 21 | Tencent | Tech / Consumer | WeChat Ecosystem & Gaming AI | 85.2 |

| 22 | Johnson & Johnson | Health | MedTech & Robotic Surgery | 84.6 |

| 23 | LVMH | Lifestyle | Luxury Brand Equity Persistence | 84.0 |

| 24 | Oracle | Tech / Cloud | Sovereign Cloud Infrastructure | 83.3 |

| 25 | Samsung Electronics | Tech / Hardware | HBM4 Memory Dominance | 82.7 |

| 26 | Toyota | Industry | Solid-State Battery Commercialization | 82.1 |

| 27 | Chevron | Energy / Infra | Geothermal & Low-Carbon Projects | 81.5 |

| 28 | Home Depot | Real Estate / Retail | Housing Market Modernization | 80.9 |

| 29 | Procter & Gamble | Lifestyle | Consumer Staple Resilience | 80.3 |

| 30 | Costco | Lifestyle | Membership-Model Growth | 79.7 |

| 31 | AbbVie | Health | Immunology Pipeline Expansion | 79.1 |

| 32 | Bank of America | Finance | AI-First Consumer Banking | 78.5 |

| 33 | Accenture | Tech / Service | Global Enterprise AI Consulting | 77.9 |

| 34 | Salesforce | Tech / SaaS | Agentforce CRM Integration | 77.3 |

| 35 | Nestlé | Lifestyle | Nutritional Science Pivot | 76.7 |

| 36 | Netflix | Media / Lifestyle | Content Personalization AI | 76.1 |

| 37 | AMD | Tech / Hardware | Instinct MI350 Accelerators | 75.5 |

| 38 | Disney | Media / Lifestyle | Integrated Parks & Digital AI | 74.9 |

| 39 | Reliance Industries | Diversified / Infra | India’s Energy & Tech Backbone | 74.3 |

| 40 | AstraZeneca | Health | Next-Gen Oncology Biologics | 73.7 |

| 41 | Shell | Energy / Infra | Integrated Gas & Renewables | 73.1 |

| 42 | ICBC | Finance | China’s Financial Stability Engine | 72.5 |

| 43 | SAP | Tech / SaaS | Business Process Automation | 71.9 |

| 44 | Adobe | Tech / Media | Creative Generative AI (Firefly) | 71.3 |

| 45 | Hermès | Lifestyle | Scarcity-Based Luxury Resilience | 70.7 |

| 46 | CATL | Industry / Infra | Global Battery Supply Sovereignty | 70.1 |

| 47 | HSBC | Finance | Asia-Europe Wealth Corridors | 69.5 |

| 48 | Cisco | Tech / Networking | AI-Integrated Cybersecurity | 68.9 |

| 49 | BYD | Industry / EV | Affordable Electric Mobility Scale | 68.3 |

| 50 | Goldman Sachs | Finance | Institutional AI Trading & M&A | 67.7 |

The General Index 2026 confirms that the market no longer rewards “growth at all costs.” In an environment of 3% GDP and 4% interest rates, the winners are those who control the Algorithms (Tech), the Energy (Infra), or the Essential Biology (Health). As we look to Day 2 of our reporting, Index.top will dive deeper into the Banking sub-category to analyze how the financial sector is funding this massive transformation.